Paperwork in electronic form has greatly simplified the maintenance of documentation, its audit, and search. It also saves time and resources for both private and public enterprises. If necessary, verify the document, using digital signature technology. The same is true for the W-9 form, which can be signed online.

How to sign a W-9 form with DigiSigner?

To correctly complete and verify the W-9 form online, it is convenient to use special services. DigiSigner does not require the installation of additional software, but it saves you time. The service uses advanced encryption technology.

You must receive the appropriate form from your employer. Your signature in the document will mean that you confirm the income indicated by the employer and agree with the taxes deducted from it.

To sign a W-9 form in DigiSigner, follow a few steps:

To sign a W-9 form in DigiSigner, follow a few steps:

- register through your email address;

- upload the prepared and completed W-9 form from the device via the “Upload” button or from the cloud storage of Dropbox or Google Drive;

- when the document is displayed in your account, click Sign;

- scroll through the form to the place where your signature is needed, and click the left mouse button;

- In the window that appears, select which type of details to use: mouse/trackpad, text, loading a signature scan from your device or a webcam image;

- adjust the position and size of the added signature and click Done above the document.

All changes are saved automatically. You can download the signed document with the “download” button on the top panel in your account. A Signed comment will be displayed under the document.

Recheck the information submitted several times, and also make sure that your tax data is required for the case, and not for fraudulent purposes.

What is a W-9 form?

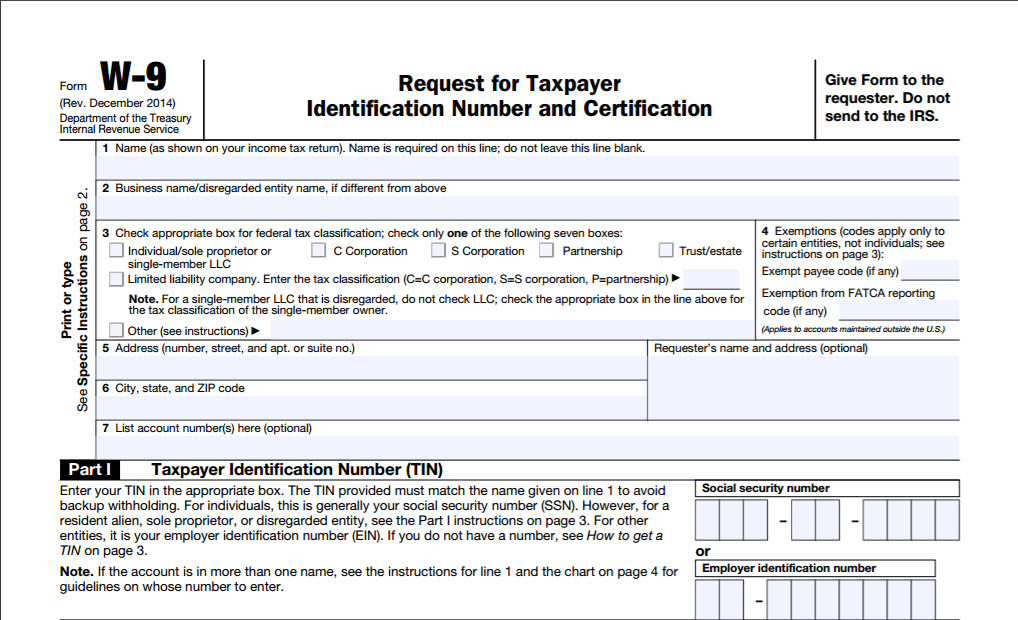

If you are an independent contractor and provide services to one or more enterprises each year, but do not join the staff, you must submit a form W-9. The primary purpose of this form is to confirm your income in the IRS if you get more than $ 600 per year.

Form W-9 is a tax document that is signed by the contractor to provide a taxpayer identification number — social security number or employer ID. If the employer does not have such a number or it is wrong, the contractor is withheld federal income tax – reserve lien.

To fill out the W-9 form correctly, follow these tips:

- repeatedly check if the identifier is entered correctly;

- fill out your type of business;

- Enter your address and full name.

Make sure you know who and for what reason asks you to fill out this information. It must be kept confidential. When sending, use only encrypted data or a secure connection.

The legality of an eSigned W-9 form?

DigiSigner uses advanced encryption standards and therefore ensures the confidentiality of your data. The signed documents comply with the requirements of the Law of Electronic Signatures in Global and National Trade (2000) and the Law of Uniform Electronic Transactions (1999).