Signing documents no longer requires as much time and action as before. The introduction of new technologies to preserve the confidentiality of information, as well as data encryption has allowed the use of electronic signatures and keep documents in electronic form.

How to sign a W-2 form with DigiSigner?

The online service DigiSigner provides the full legal force of the signature with the help of advanced encryption technology and preservation of confidentiality of information. Use the DigiSigner to sign the W-2 form online and send it to the appropriate authorities. DigiSigner requires a few simple steps to sign:

- register through your email address;

- upload the prepared and completed W-2 form from the device via the “Upload” button or from the cloud storage of Dropbox or Google Drive;

- when the document appears in the list in your account, click Sign;

- scroll through the form to the page where you need a signature, and click the left mouse button;

- in the window that appears, select which signature format to use: mouse/trackpad, text, download a signature scan from your device or a snapshot on a webcam;

- adjust the position and size of the added signature and click Done above the document.

Changes are automatically saved; it will no longer be possible to delete your signature. The prepared document is sent by the employer to the post before January 31 of each year.

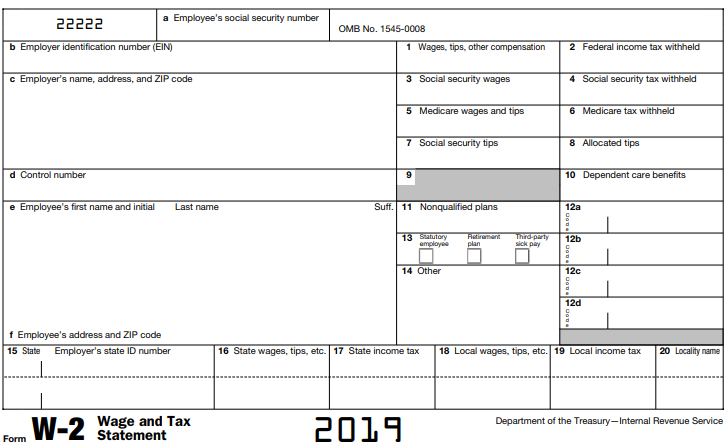

What is a W-2 form?

Every year, employers send a W-2 form to the Social Security Service — a report on salaries and taxes. This is done to report taxes and salaries of employees for the past calendar year. Also, this form must be transferred to each employee. The W-2 Social Security Service is sent along with the W-3 – Transfer of tax returns and income. Employers are required to complete a W-2 payroll form for each employee, from which:

- taxes on income, medical care, and social security are withheld;

- income tax would be withheld if the employee demanded no more than one retention allowance or did not require exemption on the W-4 form – Employee retention certificate.

Typically, the document is submitted in paper form – laser printing plates or standard red ink forms. Online, you can submit a form using Business Services certified by the state. Through the Internet, you can apply for registration of the W-2 form by first signing in electronic form.

Who signs the W-2 form?

The W-2 form is signed by the employer or the person who represents him and is responsible for calculating and calculating taxes. The second signature is put by the employee to whom the form is addressed. An employee receives this form, already signed by the employer, by e-mail. Therefore, to obtain a refund, it remains only to put your signature.

Is the W-2 form signed with DigiSigner legal?

DigiSigner offers encryption technologies that comply with current US law. An electronic signature delivered using the service has legal weight following the Law on Electronic Signatures in Global and National Trade (2000) and the Law on Uniform Electronic Transactions (1999).

Note! The document will necessarily be accepted by the Social Security Service and the tax authority at the place of residence if the employer has not made any mistakes in filling out. Before signing, check all filled fields.