The transition of many private and state-owned companies to electronic documentation has provoked an increased demand for the formation of reporting documentation in this form. But since these technologies are not yet generally accepted, questions remain about the possibilities of signing, as well as the legality of such documents.

How to sign a W-4 form in DigiSigner?

For signing electronic documents, including the W-4 form online, you can use particular services. DigiSigner does not require the installation of additional software, but it saves you time since you don’t need to visit the office to sign.

You must receive the appropriate form to your email address. Your signature in the document will mean that you are familiar with the number and amount of deductible taxes, and also fully agree with this. To sign a document in DigiSigner, follow these steps:

- Register through your email address;

- Upload the prepared and completed W-4 form from the device via the “Upload” button or from the cloud storage of Dropbox or Google Drive;

- When the document is displayed in your account, click Sign;

- scroll through the form to the page where you need your signature, and click the left mouse button;

- in the window that appears, choose which type of details to use: mouse/trackpad, text, loading a signature scan from your device or a webcam image;

- adjust the position and size of the added signature and click Done above the document.

All changes will be saved automatically. You can download the signed document with the download button on the top panel or in your account. The Signed comment will now be displayed under the document. Be careful when signing. The size of your total salary directly depends on the specified amount and amount of taxes.

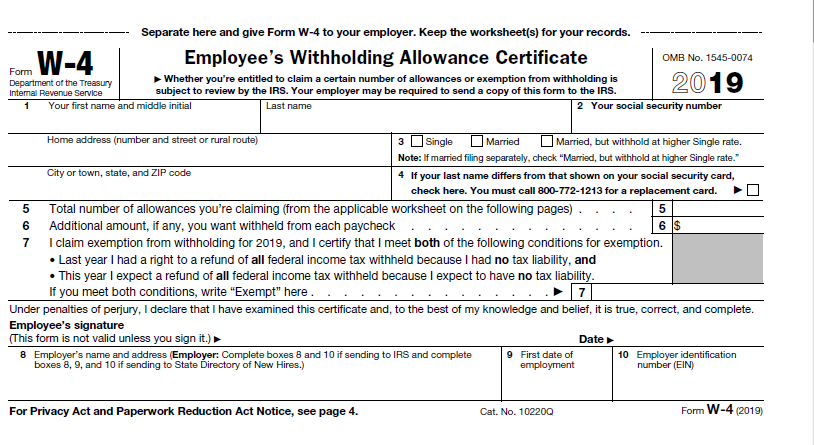

What is a W-4 form?

W-4 is a federal form that allows employees to determine how much federal income tax is withheld from their payroll. Since the company fills out this form, the employee can at any time clarify whether there are no hidden payments or other expensive items from his salary, about which he has not been notified.

At any time, an employee may request a copy of the W-4 form. The electronic version of such a document is considered legal and has proper weight if all encryption and confidentiality protocols are followed. The employer must also ensure unrestricted access to these documents for interested employees – you cannot refuse to provide a copy of the W-4 form upon request.

Who signs the W-4 form?

All new employees must complete the W-4 form to accurately determine with the employer the number of annual wages and the amount of taxation for this amount. If you have doubts about how much tax was withheld, you can always request this form and clarify.

The legality of the W-4 form, signed in DigiSigner

DigiSigner uses modern technologies of personal data protection and encryption. By signing a W-4 form online with DigiSigner, you are working with a legally valid document. Only in the case of mistakes when filling out, you may be denied acceptance of this form. It is impossible to refuse only because of the presence of the electronic signature.